Bajaj Holdings & Investment Ltd: A Leading NBFC with Strong Market Performance and Investment Potential

Company Overview

Bajaj Holdings & Invest. Ltd, was demerged from Bajaj Auto Ltd. The manufacturing work was transferred into Bajaj Auto, wind farm business and financial services business was given to Bajaj Finserv Ltd, and the properties, assets, liabilities of Bajaj Auto is transferred to Bajaj Holdings & Investments Ltd. It is registered as NBFC with RBI and it holds more than 35% stake in both Bajaj Auto Ltd and Bajaj Finserv Ltd. The revenue segments for the firm are basically interest income, fair value gain/loss and dividend income. The investments are done in Equity and debt markets; the diversification is handled as 65% investments in equity market and 35% in debt funds to balance the risk of its portfolio.

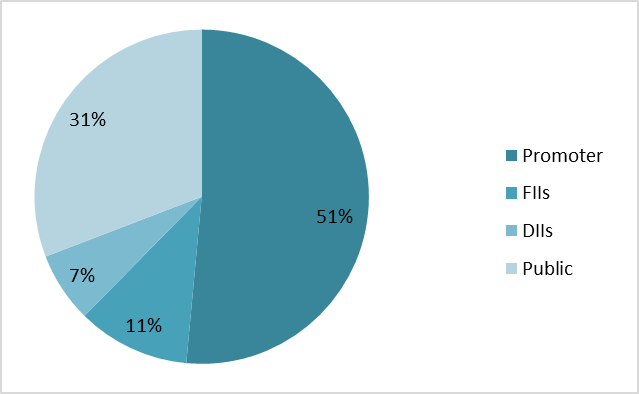

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹130761 Crore |

| Revenue | ₹1732 Crore |

| Profit | ₹7407 Crore |

| ROCE | 13.07% |

| P/E | 17.7 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | FCF |

| Bajaj Hold & Inv. | 130761 | 1732 | 7407 | 13.07% | 0.03 | 17.07 | 0.00 | 1941 |

| Bajaj Finance | 422635 | 62278 | 15373 | 11.92% | 0.17 | 16.94 | 3.74 | -73753 |

| SBI Cards | 63312 | 17749 | 2210 | 12.54% | 0.33 | 17.05 | 3.3 | -5526 |

| Shriram Finance | 108981 | 38466 | 7839 | 11.27% | 0.16 | 10.87 | 3.97 | -31635 |

| Muthoot Finance | 86144 | 14397 | 4133 | 13.15% | 0.16 | 13.31 | 2.82 | -9471 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 435 | 457 | 484 | 522 | 1702 |

| Expenses | 134 | 106 | 117 | 142 | 140 |

| EBITDA | 301 | 352 | 367 | 380 | 1562 |

| OPM | 69% | 77% | 76% | 73% | 92% |

| Other Income | 3058 | 3451 | 3896 | 4673 | 5967 |

| Net Profit | 3080 | 3654 | 4126 | 4946 | 7365 |

| NPM | 708.0% | 799.6% | 852.5% | 947.5% | 432.7% |

| EPS | 268.8 | 327.98 | 364.5 | 435.8 | 652.7 |

Latest News

The Bajaj Group, home to some of India’s most prestigious companies, has consistently delivered exceptional value to its investors. Known for its strong fundamentals and reliable returns, the group has established itself as a powerhouse for long-term wealth creation.

With the highly anticipated IPO of Bajaj Housing Finance on the horizon, an analysis by ETMarkets highlights robust performance across the Bajaj Group’s diverse portfolio. Flagship companies such as Bajaj Finance, Bajaj Finserv, Maharashtra Scooters, and Bajaj Auto have achieved extraordinary growth, with stock prices soaring over 1000%, transforming early investors into millionaires.

Bajaj Finance stands out as a prime example, delivering a staggering 2876% return over the past decade. This impressive stock performance is underpinned by solid financial growth, including a profitability CAGR of 34% and sales CAGR of 29.8% between FY14 and FY24, making it one of the most celebrated stocks in the market.

Stock Price Analysis

The share price is in growing trend and is increasing before 2020 and is still rising because the company holds the Bajaj Auto Ltd and Bajaj Finserv Ltd and they have been doing well in the market. Since Covid-19, the stock has increased 7 times from that price levels. The share traded volumes are still normal but the financials are helping the stock prices reach at new higher levels.